What I learned during my first year as a VC

A little over a year ago, through some luck and hustle, I joined Brett and Jonathon full-time at Ludlow Ventures — an early stage…

A little over a year ago, through some luck and hustle, I joined Brett and Jonathon full-time at Ludlow Ventures — an early stage technology focused venture firm. Over the course of the past year, I’ve done my best to document some of the most important lessons I’ve learned.

Reputation Is Your Most Valuable Asset

Like most jobs, in the venture capital industry, you are only as good as your reputation. This is, perhaps, one of the most obvious aspects of the venture capital industry; however, it is extremely difficult to earn. In my opinion, there are only two ways you can improve your reputation: brand and proprietary network.

Reputation is, ultimately, what enables you to see (and win) deals.

You’re Only As Good As The Deals You See

I’m certainly not the first to say this. However, I’ve learned first-hand that you are only as good as the deals you see. If you ask any investor their thoughts on this, they will almost certainly tell you that they would have preferred to pass on Facebook’s seed round than never have known of Facebook’s existence at the seed stage.

The logic is simple: you can learn and reflect on why you passed on Facebook and make sure you don’t do it again. It is significantly harder to identify why you never saw Facebook at the seed stage.

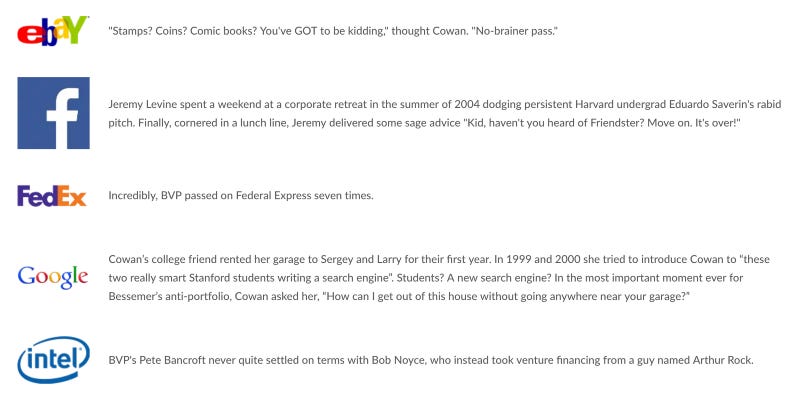

Many VC firms embrace this mentality. Bessemer, for example, created the infamous anti-portfolio. Given the extremely long feedback loops in the venture industry, it’s important to be able to reflect and understand what you got wrong (or right).

https://www.bvp.com/portfolio/anti-portfolio

Seeing every deal at the seed stage is obviously impossible, but you should make it your priority to know of as many top tier seed stage companies as possible.

Strong Independent Conviction Is Key

At the seed stage, convincing yourself that a company will fail for X, Y, and Z reasons is extremely easy.

Regardless of who you talk with, you can always poke holes into a company’s vision or plans. It’s important to listen (and understand) these concerns, but it’s equally important to identify why you should be excited.

One of the most difficult aspects of being a VC is tip-toeing the line between optimism and pessimism.

We’ve learned from many of the best venture capitalists that investing in areas that others ignore is often the key to achieving out-sized returns.

Bill Gurley said it best:

You can only make money by being right about something that most people think is wrong.

Find Your Niche

Anyone who knows me well knows that I’m obsessed with niche markets. Specifically, I’m fascinated by niche markets that have the potential to become large, mainstream markets driven by strong communities.

Sneakers and competitive video gaming are both perfect examples of markets that successfully transcended their initial niche communities.

When I joined venture full-time last year, many investors were talking about competitive video gaming or esports. The truth is that many investors were intrigued by the space, but many lacked the information needed to make meaningful investments into the space.

I grew up playing video games competitively and have watched esports grow exponentially over the past few years. As both a fan and an investor, I really want esports to succeed. One of the main ways I believe esports succeeds is by getting smart money to enter the scene. As a result, I saw a perfect opportunity to write and publicize my deep dives on esports. I mapped out over a hundred companies in the space.

I didn’t realize it at the time, but creating the esports landscape was one of the most meaningful exercises I could have ever conducted. In addition to gaining incredible insight into the esports market, I am often pinged by other investors for advice on how to navigate the space.

It’s Okay To Not Know Everything

One of the most important things I’ve learned over the past year is that it’s okay to not know everything. It might seem obvious, but out of the fear of seeming “dumb,” most tend to ignore this advice.

I can’t begin to tell you how many times, I’ve told founders: “I’m not quite sure I understand, do you mind explaining it a bit further?” Every single time, founders comment how thankful they are that I asked. Most VCs don’t ask for clarity and use their lack of understanding as an excuse to pass.

There are several well known venture capitalists, such as: Hunter Walk, Matt Mazzeo, and Semil Shah that do an incredible job of learning in public. Each of them often leverages their social clout to ask the public about topics they want to learn more about.

Every VC Has A Story

When I started to explore the idea of working in venture, I reached out to dozens of venture capitalists. I asked every single one of them the same question: “How did you end up in venture?”

To my surprise, each of them had unique stories. Some were successful founders, some were journalists, some were career VC’s, some were lawyers, etc.

It’s important to remember that, just like founders, every VC has their own story. Every single one of them has carved their own path.

Please hit recommend if you enjoyed this post!

As always, if you are ever interested in chatting more about VC, startups, OR if you want me to write about a specific topic - I'd love to hear from you.Follow me on Twitter: @blakeirHuge thanks to Brett deMarrais, Jackson Dahl, Amy Herman, and everyone else who helped with feedback on early drafts!