Modern Suppliers

Part I

Every company in the world has suppliers.

A supplier is an entity that supplies goods and services to another organization.

If you look at any automotive company, such as General Motors, they have over 15,000 global suppliers. Over the past few months, I have found myself analyzing the role of suppliers and how it translates to the software industry.

Specifically, I’ve been asking what does a “modern supplier” look like?

If you are starting or running a company today, the standard advice is that you should be doing everything you can to reach product/market fit.

However, I would take that a step further and say that you should only be focusing on your core competencies and what makes you uniquely positioned to win. Anything else is a distraction and could be a waste of valuable resources.

This is where suppliers come into the picture.

Automotive companies, for example, acknowledge that they are great at several things, such as marketing, design, assembly, and engineering. They also understand that they are not the best at manufacturing every component of a vehicle. As a result, they work with a massive network of suppliers to manufacture a vast majority of the vehicle. This enables automotive companies to focus on their core competencies and scale more efficiently.

Most people are familiar with the context and role of suppliers in the physical world, but we are still in the early innings of suppliers in a software world. In the future, similar to automotive companies, software companies will be made up of hundreds, if not thousands, of suppliers.

Every company should be asking:

Why are we building this instead of using suppliers?

Which aspects of our business need to be built in-house?

The inevitable endpoint of this is total abstraction and meta-suppliers that serve as connectors between these larger suppliers.

If you zoom far enough out, is it possible that software companies in the future are either suppliers or marketing businesses?

Enablement Layer

Suppliers, at their core, enable companies to scale more efficiently and effectively.

The enablement layer has quickly become one of the most interesting areas for software and investing. These companies are the modern suppliers. They provide the plumbing and pipes of the internet.

Modern suppliers typically have one or more of these characteristics:

Leverage software to lower the barriers of entry for new companies and markets to emerge.

Provide tooling that is difficult and resource-intensive to be built and managed in-house. This tooling is often a fixed cost and outside of a company’s core thesis.

Aligned incentives with their customers. They usually have a “pay per use” pricing model with the ability to scale operations ‘infinitely.’

Modern suppliers can take on several different form factors, such as Application Program Interface (API), Software as a Service (SaaS), Business in a Box, B2B Marketplaces, etc.

The best example of a modern supplier is Amazon Web Services (AWS).

Amazon Web Services helps organizations completely eliminate the need to build and maintain private, on-premise server infrastructures. Amazon Web Services has essentially commoditized computer power and data storage, which makes it significantly easier for new technology companies to be built. Companies are not worrying about their server infrastructure anymore. Instead, they are able to focus on their core competencies.

A number of other modern suppliers have emerged over the past few years. These suppliers help software businesses scale more efficiently and effectively. For example, this is what a company’s supplier stack might look like today:

Most of the modern suppliers, today, are focused on fairly broad use-cases. However, there are endless opportunities for new suppliers to emerge. The more complex and regulated an industry is, the more opportunities there are for suppliers. Modern suppliers that specialize in heavily regulated industries help abstract away the intricacies of these industries.

Plaid, for example, has made it significantly easier for consumer fintech companies to launch by creating a simple and seamless way for consumers to link their bank accounts.

The Unbundling & Bundling

We are in an endless cycle of unbundling and bundling. Historically, unbundling is where the disruption happens, while bundling is for convenience. Unbundled suppliers are tackling very specific issues within an organization, while bundled suppliers are often building platforms for organizations to run their entire business on.

Within the context of modern suppliers, bundled suppliers are often platforms designed specifically for certain industries and use-cases.

For instance, if you don't know how to build your own blog and subscription membership, you might opt to use Substack to run your newsletter business. Substack is one of the easiest ways to run and manage a newsletter business.

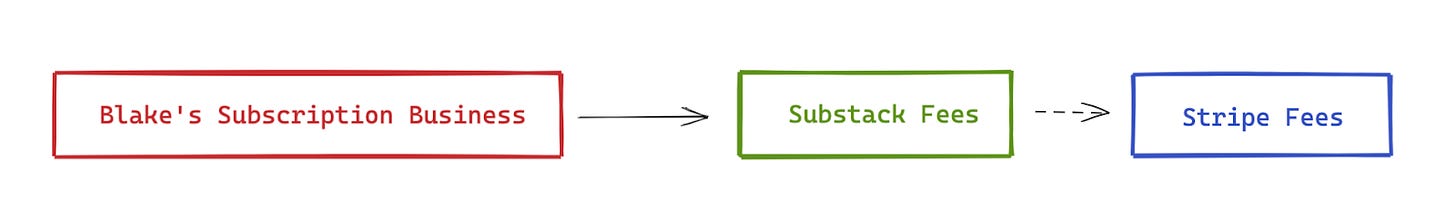

The interesting nuance is that these bundled platforms are often still paying a tax to base level suppliers that power their bundled platforms.

If you run a newsletter business on Substack, Substack is still using Stripe to handle payment processing. More precisely, you can consider Stripe a tier-2 supplier to Substack, a term often used in manufacturing.

In the manufacturing world, tiered suppliers are commonplace. Tier-1 suppliers are companies that supply parts or systems directly to original equipment manufacturers (OEMs). While Tier-2 suppliers supply components to Tier-1s, and Tier-3 suppliers supply the raw materials or parts to Tier-2s, etc.

This tiered dynamic will also occur within the software world. Stripe and Substack is just one example of this.

We can expect more bundled suppliers to be built around offering elegant, frictionless platforms.

However, businesses and individuals may still opt for an unbundled approach by assembling suppliers a la carte to meet their needs.

Ben Thompson's Stratechery supplier stack is a great example of this:

It’s worth noting that Ben Thompson started his blog, Stratechery, in 2013. There were very few bundled suppliers at the time. Thus, Ben opted to use these suppliers a la carte. It’s interesting to think through whether or not Ben Thompson and Stratechery would use Substack if he was starting his newsletter today. Given the scale of Stratechery, I think you could make a compelling argument that Ben should continue to opt for this more custom approach as he is, presumably, able to retain a much larger percentage of revenue.

Pay-Per-Use Tax

The unique advantage of being the plumbing and pipes of the internet is that you get to grow alongside your customers.

A clear example of this is WhatsApp & Twilio. Twilio is a communications API that makes it significantly easier to programmatically make and receive phone calls, send and receive text messages, and perform other communication functions.

Earlier this year, JP Morgan Equity Research reported that WhatsApp is estimated to be a $100M revenue run-rate customer for Twilio. Twilio is a supplier to WhatsApp. They handle some of the ‘plumbing’ while WhatsApp gets to focus on what makes them truly unique. As WhatsApp continues to grow, they pay Twilio a ‘tax’ for every new user that signs up.

The incentives of modern suppliers are often aligned with their customers (companies). As a company scales, they are able (and willing) to pay a “tax” to their suppliers.

Chamath Palihapitiya from Social Capital famously coined the “AWS tax” several years ago:

AWS is a tax on the compute economy. So whether you care about mobile apps, consumer apps, IoT, SaaS etc, more companies than not will be using AWS vs building their own infrastructure. Ecommerce was AMZN’s way to dogfood AWS, and continue to do so so that it was mission grade. If you believe that over time the software industry is a multi, deca-trillion industry, then ask yourself how valuable a company would be who taxes the majority of that industry? 1%, 2%, 5% — it doesn’t matter because the numbers are so huge — the revenues, profits, profit margins, etc. I don’t see any cleaner monopoly available to buy in the public markets right now.

Monopoly

While the incentives of modern suppliers and companies are fairly aligned, it’s important to highlight the potential ‘monopolies’ that these suppliers can form over time.

Let’s use Stripe as an example. Stripe is an API that makes it easier to accept payments, send payouts, etc.

10 years ago, you might have hired a payments engineer to build this internally.

Today, you can leverage Stripe’s API to handle a lot of the heavy lifting. This is largely a win for your company, as you no longer need to incur the risk or costs of developing this in-house. You get to outsource this to the ‘experts’ on payment infrastructure. The best payment engineers will presumably continue to go to Stripe, thus their moat will continue to grow. The larger that Stripe becomes, the greater advantage Stripe has in pricing, hiring, etc.

By obfuscating the payments infrastructure and using Stripe early in your company's lifecycle, you might actually be faced with fewer alternatives over time. Your company will likely end up paying Stripe a ‘tax’ forever in the same way that you do with Amazon Web Services (AWS).

There is no better illustration of this than my favorite passage from Aldo Leopold’s "A Sand County Almanac”

There are two spiritual dangers in not owning a farm. One is the danger of supposing that breakfast comes from the grocery, and the other that heat comes from the furnace. To avoid the first danger, one should plant a garden, preferably where there is no grocer to confuse the issue. To avoid the second, he should lay a split of good oak on the andirons, preferably where there is no furnace, and let it warm his shins while a February blizzard tosses the trees outside.

These modern suppliers are fundamentally democratizing the opportunity for anyone to build and scale. It’s, arguably, never been easier to start a software company. However, distribution and attention is the bottleneck for most companies.

We are starting to see a clear bifurcation of suppliers and marketing companies.

Suppliers focus specifically on certain elements of a business, while marketing companies are focused solely on captivating and nurturing an audience and community.

In Part 2, I will cover the “White Label of Everything” and the opportunity that companies with engaged audiences and communities can unlock by leveraging these modern suppliers.

Special thanks to Amy Robbins, Jerry Lu, Jackson Dahl, and Li Jin for providing feedback on this post.