Arming The Rebels of The Future

Shopify’s approach to competing with Amazon provides us with a glimpse into the evolution of on-demand businesses.

Photo by Luís Feliciano on Unsplash

If you take a step back and analyze how Shopify has managed to compete with Amazon, I think we can get a glimpse into the evolution of on-demand businesses.

Shopify is a platform. Shopify doesn’t interface with any consumers directly. Instead, they opted to power over 800,000 businesses across the world. These merchants are then responsible for acquiring their own customers.

While Amazon has taken a different approach. They have opted to own the entire end-user experience. Ben Thompson has perfectly summarized Amazon’s approach as “[Amazon] tends to internalize their network effects and commoditize their suppliers.”

Last month, Tobi Lutke, the co-founder and CEO of Shopify, was asked if ‘Shopify was the next Amazon.’ His response was incredible, and he said this: “Amazon is trying to build an empire and Shopify is trying to arm the rebels.”

If you apply this lens to the gig economy, it’s not hard to see that there is a massive opportunity to explore. The incumbents today have optimized for a winner-take-all market.

“Uber is trying to build an empire and ____ is trying to arm the rebels.”

“DoorDash is trying to build an empire and ___ is trying to arm the rebels.”

“Instacart is trying to build an empire and ___ is trying to arm the rebels.”

With that being said, there are a couple of major differences from the Amazon/Shopify example that are worth highlighting:

The incumbents have already found product-market fit.

Consumers are optimizing for a combination of price, speed, and convenience, and quality of service.

If everyone is offering similar services and the incumbents have reached critical mass in hundreds of markets, the same question will keep popping up, how can you possibly compete?

If you follow a similar playbook to Shopify, you would start by empowering the suppliers rather than attempting to commoditize them. The supply side (drivers) is one of the most critical components of the on-demand economy. And, it’s not exactly a secret that the supply side in today’s ecosystem feels very undervalued.

In fact, a lot of gig-economy workers are forced to act as owners of businesses, but they don’t have the autonomy OR compensation to reflect that. Instead, the value continues to accrue to the incumbents.

So…what would happen if you ‘armed the rebels’ to actually run their own businesses?

The Modern Franchise

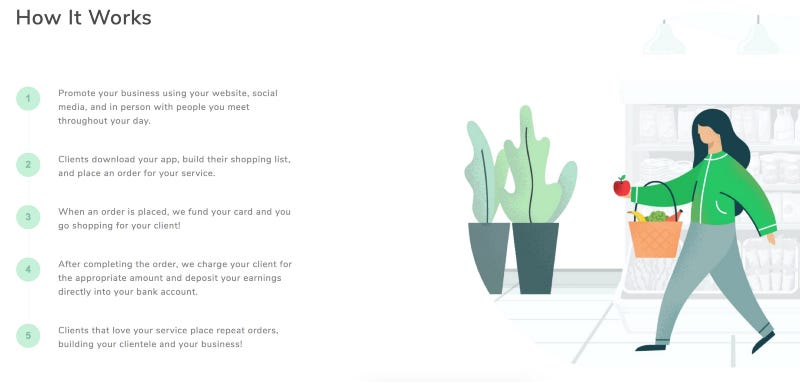

A couple of months ago, we saw one of the first companies emerge to tackle this called: Dumpling. Dumpling is a Seattle-based startup that offers a platform to help individuals run their own grocery delivery business and cultivate personal relationships with clients. Dumpling raised $3M from Floodgate and Fuel Capital earlier this year.

In an interview with TechCrunch, the founders spoke a bit about their motivation for starting Dumpling:

We started talking with gig workers and we asked: ‘Why are you working for a terrible company where you’re getting injured, where you’re getting penalized for not taking the next job?’ And the response was ‘money.’ It was, ‘I need to be able to buy these groceries and I don’t want to put them on my own credit card.’

That was an epiphany for us. If the biggest pain point to running these businesses is working capital and we can solve that — if business owners will pay for access to capital and for tools that help them run their business — that clicked for us.

In short, Dumpling gives independent shoppers a company credit card to buy goods along with operational support and an online storefront. The average shopper on Dumpling is bringing home roughly three times as much as when they work for other grocery delivery apps. The most fascinating element of the Dumpling approach is that these independent shoppers are responsible for building out their own book of business.

Their pitch to professional shoppers is straight forward and very compelling:

Earn 2X per shop compared to Instacart.

Set your prices and don’t worry about them changing.

Keep 100% of your tips. Period.

Schedule your deliveries ahead of time and plan your day (and your life) accordingly!

Work with the customers you want to work with. You’re never forced to take an order.

Delight your customers, get repeat business. Benefit from your hard work.

Make more money, make your own schedule, and build your own book of business.

Dumpling is ‘arming the rebels’ while continuing to capture some of the value. They are also in a unique position where they get to focus a majority of their energy and resources into building differentiated products and services for their operators. As mentioned above, if you’re going to compete with the incumbents in this space, you will have to optimize to differentiate across price, speed, and convenience, and quality of service.

For Dumpling, it appears they are very focused on differentiating themselves from the incumbents via quality of service and price. It’s not hard to imagine Dumpling moving into other verticals outside of grocery delivery.

The major difference between Dumpling and Instacart is how they acquire customers. For Dumpling, they put that responsibility on the independent operators, while Instacart is actually going out to acquire users. This is also the most common rebuttal for why Instacart (and other incumbents) are able to demand a higher take rate from their drivers.

It will be fascinating to see how Dumpling evolves and continues to arm their independent shoppers. It appears that they are working to build up the demand side of the marketplace as well, but driving consumers directly to the Dumpling application if they want to find independent shoppers in their neighborhood.

One of the biggest question marks for the modern franchise is how do you ensure high quality across the entire platform? For Dumpling, this is a risk that they take on by tying everything under one platform vs. standalone brands (Shopify).

The Ghost Franchise

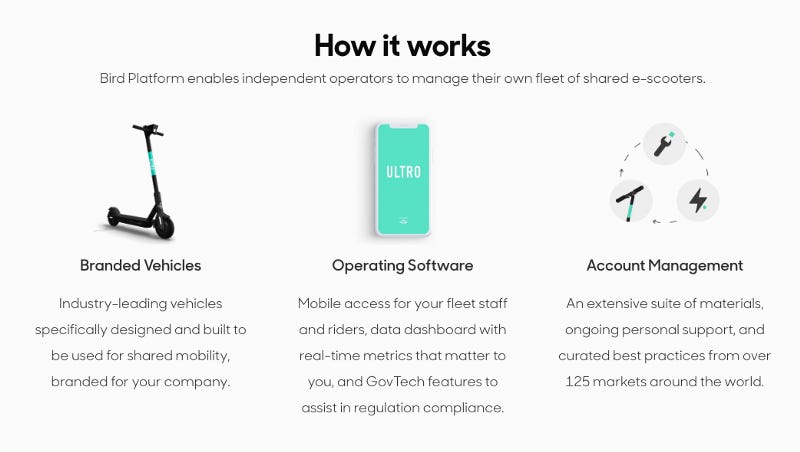

We are seeing an interesting shift in the ‘winner-take-all’ mentality of incumbents today. The micro-mobility industry, for example, has been flooded with competitors over the past few years. Each incumbent has taken a different approach, but I think Bird has taken the smartest (and most unique) approach.

At the end of 2018, Bird announced Bird Platform. Bird Platform enables entrepreneurs and small business owners to launch their own white-labeled scooter company.

Bird sells its vehicles at-cost to all independent operators participating on the platform with the flexibility to brand the scooters and run through the Bird app. They also allow you to set your pricing, operating hours, zoning, etc. In exchange for allowing you to run your own independent scooter business, they charge a service fee on every scooter ride.

Bird understands where their strengths are (scooter, software, fleet management, etc.) and they are enabling others to run the consumer-facing product.

This is a major shift from the Uber/Lyft strategy of where they had to continue to raise large amounts of capital to fuel growth and expansion. Bird is now able to leverage their network of independent operators to scale globally while taking part in the upside. Bird is now able to focus on where they can actually differentiate from the competition (hardware) and ancillary products/services.

My hypothesis is that we will start to see a lot of companies, especially those that are prone to competition, will start to follow the Bird strategy of ‘franchising’ their core competencies to others.

Removing The Gatekeepers

One of the promises of the internet is that anyone should be able to monetize their skills and time. As consumers, we should be supporting these independent business owners. Platforms that are built around empowering their supply base to compete with incumbents will flourish in the next wave of internet companies.

If you are building the picks and shovels to arm the rebels of the future, I would love to chat with you.

More thoughts on this soon! To be continued…